To break even, your business needs to sell $35,955 in products and services. Remember all the little examples we sprinkled throughout this post? All those figures link back to what we’ve illustrated in the video. As a result, your balance sheet payments are $7,000. The principal portion of loan payments, payments to investors and shareholders, and owner draws are all examples of balance sheet payments.Įxample: Let's pretend you take a $5,000 owner's draw from your company each month and an additional $2,000 you need to pay in principal payments on debt. Balance Sheet Paymentsīalance sheet payments are monthly expenses that are not classified as an expense in typical accounting terms. That’s a big mistake! Calculate your break-even point with the marketing budget built in so your company can grow.Įxample: Let's pretend that you have $25,000 in overhead costs. They do this because if things get bad, marketing is often one of the first things to go in order to save money.

#Break even point pro

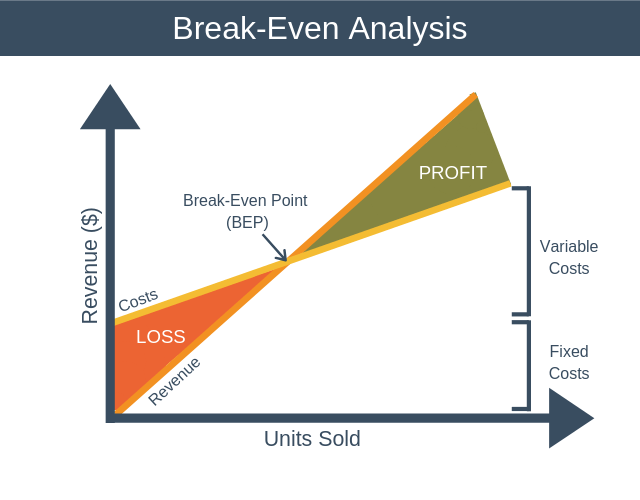

Pro tip: Most people cut out marketing, which is a big no-no. Add up every dollar that you spend each month to see your total overhead costs. Rent, insurance, administrative payroll, and marketing all fall under overhead. Overhead costs are the operational costs that you incur within your business regardless of how successful you are. This means that for every dollar you sell in products or services, you get to keep 89 cents to go toward your company’s overhead costs. It includes how much profit you make before you subtract selling, general, and administrative costs.Įxample: Pretend your gross margin is 89 percent. Your gross margin-or gross profit margin-is your company's net sales minus the costs of producing your goods and services. With all of the expenses that come along with running your business, it can be intimidating, but you only need three things to calculate your break-even point: gross margin, overhead costs, and balance sheet payments. How do you calculate a break-even point already?!” Just a few more details to remember-we promise.

0 kommentar(er)

0 kommentar(er)